How To Write a Winning Cookie Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for cookie businesses who want to improve their strategy and/or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every cookie business owner should include in their business plan.

Download the Ultimate Cookie Business Plan Template

What is a Cookie Business Plan?

A cookie business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons your cookie business will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write a Cookie Business Plan?

A cookie business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use a business plan as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business. Having a well written cookie business plan will allow potential investors to gain confidence in the feasibility of your cookie shop.

Cookie Business Plan Template

The following are the key components of a successful cookie business plan:

Executive Summary

The executive summary of a cookie business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your cookie company

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company, as well as a company analysis. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your cookie business, you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your cookie firm, mention this.

You will also include information about your chosen cookie business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

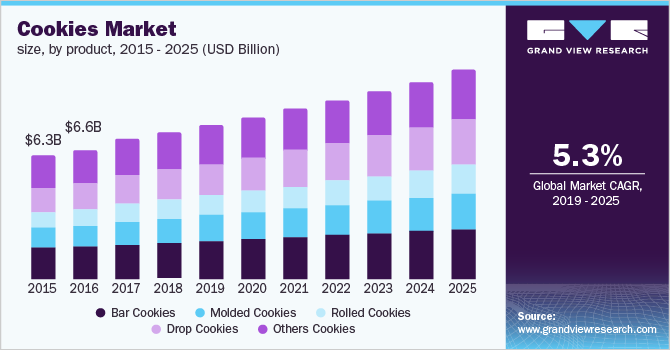

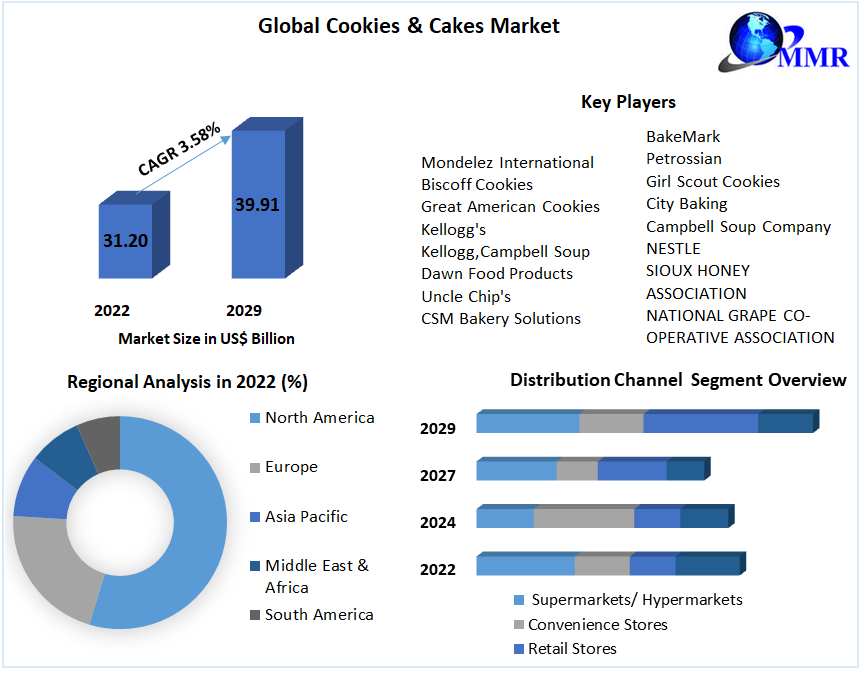

The industry or market analysis is an important component of a cookie business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the cookie industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target market with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, customers of a cookie business may include:

- People who are health conscious and are looking for a nutritious dessert

- Busy parents who are looking for an easy and convenient snack for their kids

- Working professionals who are looking for a quick sweet treat to have at their desk

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or cookie services with the right marketing.

Competitive Analysis

The competitive analysis section of the cookie business plan helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

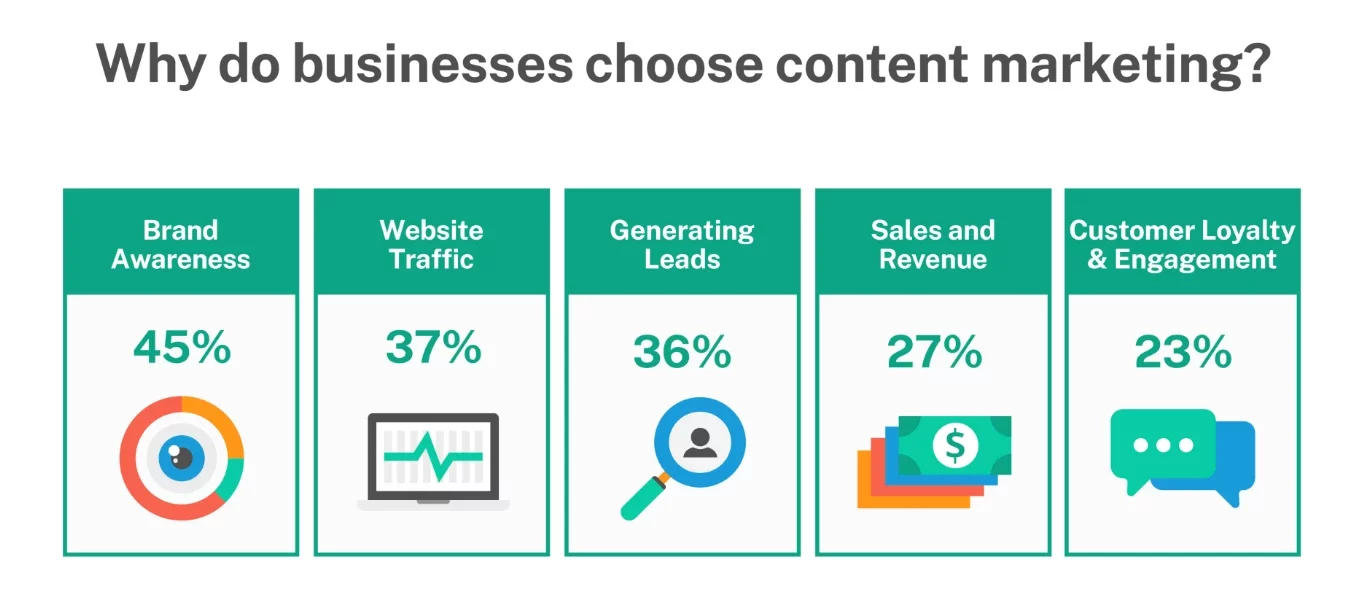

Marketing Plan

This part of the cookie business plan is where you determine and document your marketing plan. Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign. Or, you may promote your cookie business via word-of-mouth and referrals.

Operations Plan

This part of your cookie business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for a cookie business include reaching $X in sales. Other examples include adding new specialty cookies or services, expanding to new markets, reaching a certain number of social media followers, or opening new locations.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific cookie industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Cookie Company

Balance sheet.

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash, or personal savings contributed to the cookie business).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Cookie Company

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup cookie business.

Sample Cash Flow Statement for a Startup Cookie Company

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your cookie company. It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it.

A well-written business plan is an essential tool for any startup cookie company. In addition, a good business plan should include detailed financial projections, as well as a list of your company’s policies and procedures. This can attract investors and set the foundation for your successful cookie business.

Finish Your Cookie Business Plan in 1 Day!

How to Start a Profitable Cookie Business [11 Steps]

By Nick Cotter Updated Feb 05, 2024

Business Steps:

1. perform market analysis., 2. draft a cookie business plan., 3. develop a cookie brand., 4. formalize your business registration., 5. acquire necessary licenses and permits for cookie., 6. open a business bank account and secure funding as needed., 7. set pricing for cookie services., 8. acquire cookie equipment and supplies., 9. obtain business insurance for cookie, if required., 10. begin marketing your cookie services., 11. expand your cookie business..

Embarking on a cookie business adventure begins with a thorough understanding of the market landscape. This crucial step involves identifying potential customers, understanding competitors, and recognizing market trends. Here's how to perform a comprehensive market analysis:

- Research your target audience: Identify demographics, preferences, and purchasing behaviors to tailor your cookie offerings.

- Analyze competitors: Study existing cookie businesses to evaluate their product range, pricing, marketing strategies, and customer base.

- Understand market trends: Keep abreast of the latest developments in the food industry, such as health-conscious baking, seasonal flavors, or packaging innovations.

- Assess the supply chain: Determine the availability and cost of ingredients, packaging materials, and delivery options.

- Gauge market demand: Use surveys, focus groups, and sales data to estimate the potential demand for your cookies.

- Regulatory considerations: Familiarize yourself with food safety regulations, labeling requirements, and any other legal aspects pertinent to running a cookie business.

Are Cookie businesses profitable?

Yes, cookie businesses can be very profitable. Many entrepreneurs have found success by selling homemade cookies online, at farmers' markets, or through catering services. Additionally, franchising a cookie business can be a great way to turn a profit, as it allows the franchisee to leverage the brand's existing infrastructure and customer base.

Embarking on a cookie business venture requires a well-thought-out plan to ensure success. Drafting a comprehensive business plan is crucial as it will guide you through each phase of your business development. Here's what you should consider including in your cookie business plan:

- Executive Summary: An overview of your cookie business, including mission statement and key selling points.

- Market Analysis: Research on target market, customer demographics, and analysis of competitors.

- Product Line: Detailed description of the cookie varieties you will offer, including any unique flavors or dietary options.

- Business Structure: Legal structure of your business, ownership information, and the required permits/licenses.

- Marketing and Sales Strategy: How you plan to attract and retain customers, including pricing, advertising, and sales channels.

- Operations Plan: Day-to-day operations details, supplier information, production processes, and staffing requirements.

- Financial Projections: Budget, projected revenue, profit margins, and break-even analysis to ensure financial feasibility.

How does a Cookie business make money?

A cookie business can make money by selling their cookies to customers. They can also sell their cookies to other businesses like restaurants, cafes, and supermarkets. Additionally, they can also offer custom orders for special events, offer subscription services, or even offer online ordering and delivery services.

Creating a unique cookie brand is an essential step in distinguishing your products in a competitive market. It involves crafting a memorable identity that resonates with your target audience and reflects the quality and uniqueness of your cookies. Here are some key points to consider when developing your cookie brand:

- Identify your target market and understand their preferences to tailor your brand's message and aesthetics.

- Choose a brand name that is catchy, easy to remember, and gives an idea of what your cookies are about.

- Design a logo and packaging that stand out on shelves, are visually appealing, and communicate your brand’s values.

- Develop a unique selling proposition (USP) that highlights what makes your cookies special, such as a unique flavor, ingredient, or baking method.

- Create a consistent brand voice and personality across all marketing materials and social media channels to build a strong brand identity.

- Ensure your branding is reflected in the quality of your cookies – use high-quality ingredients and maintain a consistent product quality.

How to come up with a name for your Cookie business?

Coming up with a name for your cookie business can be a fun and challenging process. Brainstorming ideas and exploring different words, colors, and symbols can be a great starting point. Once you have a few ideas, choose one that best reflects the core values of your business, such as freshness and quality. You should also make sure the name is memorable and easy to pronounce so customers can easily find your business.

Once you've crafted your business plan, tested your cookies, and understood your market, it's time to make things official. Formalizing your business registration legitimizes your enterprise and is essential to operate legally. Here's how to get started:

- Determine your business structure (e.g., sole proprietorship, partnership, LLC, or corporation) as this will impact your taxes, liability, and paperwork.

- Register your business name with the appropriate state authority, which is often the Secretary of State's office, ensuring it is unique and not already in use.

- Obtain an Employer Identification Number (EIN) from the IRS for tax purposes, which is necessary even if you don't have employees.

- Apply for the necessary business licenses and permits. Your local health department will guide you on the food service permits required for a cookie business.

- Understand and prepare for your state’s sales tax requirements. Register with your state's taxation agency to collect sales tax if applicable.

- Consider registering for a Doing Business As (DBA) if you're operating under a name different from your legal business name.

Resources to help get you started:

Explore indispensable resources created for cookie entrepreneurs that provide market insights, operational guidance, and strategies for business expansion:

- BakeryAndSnacks.com: Offers up-to-date news and analysis on the global baking and snack industry, including trends affecting cookie businesses. Visit site .

- The Bakery Network: A comprehensive service providing industry reports, supplier directories, and operational advice specifically useful for cookie entrepreneurs. Visit site .

- Modern Baking: An online publication featuring articles on market trends, recipes, equipment, and business strategies tailored to the modern baking professionals, including cookie business owners. Visit site .

- Snack Food & Wholesale Bakery: Publishes industry news, trends, and innovations in the snack food and bakery sector, with relevant content for cookie businesses. Visit site .

- Baking Business: Provides news, trends, and best practices for the baking industry, with resources suited to helping cookie businesses grow. Visit site .

Starting a cookie business requires compliance with local, state, and federal regulations to ensure your operation is legal and safe. The type of licenses and permits you need may vary based on your location and the specifics of your business. Here's a guide to help you navigate the process:

- Business License: Register your cookie business with your city or county to obtain a general business license, allowing you to operate legally.

- Food Service License: Acquire a food service license from the local health department, which involves an inspection to ensure your kitchen meets food safety standards.

- Cottage Food License: If operating under cottage food laws, apply for a cottage food license, which may have specific requirements and limitations.

- Sales Tax Permit: Register for a sales tax permit with your state's department of revenue to collect and remit sales tax, if applicable.

- Employer Identification Number (EIN): If you plan to hire employees, obtain an EIN from the IRS for tax purposes.

- Zoning Permit: Ensure your business location is zoned for commercial use if you are not operating from home, or confirm that home-based businesses are allowed in your area.

What licenses and permits are needed to run a cookie business?

The type of licenses and permits needed to run a cookie business can vary depending on the location. Some of the most common requirements include a business license, a food handler's permit, and a seller's permit. Depending on the size of the business, additional requirements such as health inspections and zoning permits may be necessary.

Starting a cookie business requires careful financial management, which is why opening a dedicated business bank account is crucial. It separates personal and business finances, simplifying accounting and tax reporting. Additionally, securing the right funding can fuel your startup's growth and help cover initial costs.

- Research local and national banks or credit unions that offer business banking services. Look for ones with low fees, good customer service, and easy access to funds.

- Prepare the necessary documents to open a business bank account, typically including your business license, EIN, and organizational documents.

- Consider different types of funding, such as personal savings, loans from family and friends, bank loans, or small business grants and loans from the government.

- Explore small business lenders and compare terms. Pay close attention to interest rates, repayment terms, and any additional fees.

- If eligible, apply for a business credit card to help manage cash flow and build your business credit history.

- Create a solid business plan to present to potential investors or lenders, showing your business's potential for success and how you plan to use the funds.

Setting the right price for your cookies is crucial to attract customers while ensuring you cover costs and make a profit. Consider the cost of ingredients, time, packaging, and other overheads. Below are some tips to help you set competitive and profitable prices for your cookie services:

- Calculate the cost of ingredients per batch and divide by the number of cookies to find the cost per cookie.

- Factor in the time spent baking and decorating. Assign a labor cost per hour and add it to the cost per cookie.

- Include overhead costs such as kitchen rental, utilities, and insurance, spread out over the expected number of cookies sold.

- Research competitor pricing to ensure your prices are in line with the market while reflecting the quality of your product.

- Consider offering tiered pricing for bulk orders or special events to cater to different customer needs.

- Don't forget to factor in profit margins. A common approach is to mark up the total cost by a certain percentage.

- Regularly review and adjust prices as necessary, taking into account changing costs and competitor pricing.

What does it cost to start a Cookie business?

Initiating a cookie business can involve substantial financial commitment, the scale of which is significantly influenced by factors such as geographical location, market dynamics, and operational expenses, among others. Nonetheless, our extensive research and hands-on experience have revealed an estimated starting cost of approximately $12000 for launching such an business. Please note, not all of these costs may be necessary to start up your cookie business.

When starting your cookie business, it's crucial to equip yourself with the right tools and supplies. High-quality equipment will enable you to produce delicious cookies efficiently and safely. Below is a list of essential items you'll need to kickstart your baking endeavors:

- Commercial Oven: Choose a reliable oven that can handle the volume of cookies you plan to bake.

- Mixers: Invest in sturdy stand mixers for consistent dough and batter mixing.

- Baking Sheets and Pans: Stock up on various sizes to accommodate different cookie types.

- Measuring Tools: Accurate measuring cups and spoons are vital for precise recipes.

- Cooling Racks: These allow air to circulate around cookies to cool them quickly and prevent sogginess.

- Packaging Supplies: Purchase attractive and food-safe containers, boxes, or wrappers for your cookies.

- Decorating Tools: If offering decorated cookies, get piping bags, tips, and other decorating utensils.

- Food Safety Equipment: Gloves, hairnets, and aprons to maintain hygiene standards.

- Storage Solutions: Airtight containers to store ingredients and finished cookies.

List of Software, Tools and Supplies Needed to Start a Cookie Business:

Software: Point-of-sale system, accounting software, website building software, email marketing software.

Tools: Mixing bowls, measuring cups, baking sheets, rubber spatulas, cooling racks, ovens, mixers.

Supplies: Cookie cutters, parchment paper, food coloring, cake decorations, sprinkles, icing bags, rolling pins.

Protecting your cookie business with the right insurance is crucial for mitigating risk and ensuring the longevity of your enterprise. Different types of insurance will cover various aspects of your business, from liability to property damage. Here are key points to consider when obtaining business insurance:

- Assess your business needs to determine the type of insurance that's most relevant for your cookie business, such as general liability insurance, product liability insurance, or commercial property insurance.

- Contact a licensed insurance agent or broker who specializes in business policies to help you navigate the options and find the best coverage for your needs.

- Consider the scale of your business, including the volume of production, distribution methods, and number of employees, as these factors will influence the type and extent of coverage you require.

- Be sure to inquire about any insurance requirements your state or local jurisdiction may have for food-based businesses to ensure you are compliant with local laws.

- Regularly review and update your insurance policy to reflect changes in your business, such as expansion or new product lines, to maintain adequate coverage.

Marketing your cookie business is a crucial step to attract customers and generate sales. By employing a mix of traditional and digital marketing strategies, you can create a strong presence both online and in your local community. Here are some effective ways to market your cookie services:

- Develop a Brand Identity: Create a memorable logo, choose a color scheme, and develop a unique selling proposition to differentiate your cookies from the competition.

- Build a Website: Set up an attractive, user-friendly website where customers can learn about your products, place orders, and find contact information.

- Use Social Media: Create profiles on popular platforms like Instagram, Facebook, and Pinterest to showcase your cookie designs and interact with potential customers.

- Email Marketing: Collect email addresses and send out newsletters with special offers, new product announcements, and cookie tips to keep your brand top-of-mind.

- Local Networking: Attend local events, join business groups, and partner with other businesses to reach more customers in your community.

- Offer Promotions: Run introductory offers, referral discounts, or seasonal sales to encourage people to try your cookies.

- Invest in Paid Advertising: Consider using targeted ads on social media or Google to reach a larger audience and drive traffic to your website.

Once your cookie business has established a solid foundation and a loyal customer base, it's time to consider growth opportunities. Expanding your business wisely can lead to increased profits and a broader market presence. Here are a few strategies to help you scale up effectively:

- Introduce new flavors or limited-edition cookies to keep your product range exciting and encourage repeat business.

- Partner with local cafes or stores to sell your cookies, expanding your reach beyond direct sales to customers.

- Invest in online marketing and social media campaigns to increase your brand's visibility and attract new customers.

- Explore catering options for events and corporate orders to tap into a larger market with high-volume sales potential.

- Consider e-commerce and set up an online store to sell your cookies nationwide or even internationally.

- Attend food expos and craft fairs to showcase your cookies, network with industry professionals, and gain valuable exposure.

- Offer customization and personalization options for special occasions, which can command higher prices and customer loyalty.

- Optimize your operations with better equipment or more efficient processes to increase production without compromising quality.

How to Start a Cookie Business

Starting a cookie business can be very profitable. With proper planning, execution and hard work, you can enjoy great success. Below you will learn the keys to launching a successful cookie business.

Importantly, a critical step in starting a cookie business is to complete your business plan. To help you out, you should download Growthink’s Ultimate Business Plan Template here .

Download our Ultimate Business Plan Template here

14 Steps To Start a Cookie Business :

- Choose the Name for Your Cookie Business

- Develop Your Cookie Business Plan

- Choose the Legal Structure for Your Cookie Business

- Secure Startup Funding for Your Cookie Business (If Needed)

- Secure a Location for Your Business

- Register Your Cookie Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Cookie Business

- Buy or Lease the Right Cookie Business Equipment

- Develop Your Cookie Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Cookie Business

- Open for Business

1. Choose the Name for Your Cookie Business

The first step to starting a cookie business is to choose your business’ name.

This is a very important choice since your company name is your brand and will last for the lifetime of your business. Ideally you choose a name that is meaningful and memorable. Here are some tips for choosing a name for your cookie business:

- Make sure the name is available . Check your desired name against trademark databases and your state’s list of registered business names to see if it’s available. Also check to see if a suitable domain name is available.

- Keep it simple . The best names are usually ones that are easy to remember, pronounce and spell.

- Think about marketing . Come up with a name that reflects the desired brand and/or focus of your cookie business.

2. Develop Your Cookie Business Plan

One of the most important steps in starting a cookie business is to develop your cookie business plan . The process of creating your plan ensures that you fully understand your market and your business strategy. The plan also provides you with a roadmap to follow and if needed, to present to funding sources to raise capital for your business.

To enhance your planning process, incorporating insights from a sample cookie business plan can be beneficial. This can provide you with a clearer perspective on industry standards and effective strategies, helping to solidify your own business approach.

Your plan should include the following sections:

- Executive Summary – this section should summarize your entire business plan so readers can quickly understand the key details of your cookie business.

- Company Overview – this section tells the reader about the history of your cookie business and what type of cookie business you operate. For example, are you a bakery, grocery store, cookie specialty store, or a homemade cookie business?

- Industry Analysis – here you will document key information about the cottage food industry. Conduct market research and document how big the industry is and what trends are affecting it.

- Customer Analysis – in this section, you will document who your ideal or target customers are and their demographics. For example, how old are they? Where do they live? What do they find important when purchasing products like the ones you will offer?

- Competitive Analysis – here you will document the key direct and indirect competitors you will face and how you will build competitive advantage.

- Marketing Plan – your marketing plan should address the 4Ps: Product, Price, Promotions and Place.

- Product : Determine and document what products/services you will offer

- Prices : Document the prices of your products/services

- Place : Where will your business be located and how will that location help you increase sales?

- Promotions : What promotional methods will you use to attract customers to your cookie business? For example, you might decide to use pay-per-click advertising, public relations, search engine optimization and/or social media marketing.

- Operations Plan – here you will determine the key processes you will need to run your day-to-day operations. You will also determine your staffing needs. Finally, in this section of your plan, you will create a projected growth timeline showing the milestones you hope to achieve in the coming years.

- Management Team – this section details the background of your company’s management team.

- Financial Plan – finally, the financial plan answers questions including the following:

- What startup costs will you incur?

- How will your cookie business make money?

- What are your projected sales and expenses for the next five years?

- Do you need to raise funding to launch your business?

Finish Your Business Plan Today!

3. choose the legal structure for your cookie business.

Next you need to choose a legal business structure for your cookie business and register it and your business name with the Secretary of State in each state where you operate your business.

Below are the five most common legal structures:

1) Sole proprietorship

A sole proprietorship is a business entity in which the owner of the cookie business and the business are the same legal person. The owner of a sole proprietorship is responsible for all debts and obligations of the business. There are no formalities required to establish a sole proprietorship, and it is easy to set up and operate. The main advantage of a sole proprietorship is that it is simple and inexpensive to establish. The main disadvantage is that the owner is liable for all debts and obligations of the business.

2) Partnerships

A partnership is a legal structure that is popular among small business owners. It is an agreement between two or more people who want to start a cookie business together. The partners share in the profits and losses of the business.

The advantages of a partnership are that it is easy to set up, and the partners share in the profits and losses of the business. The disadvantages of a partnership are that the partners are jointly liable for the debts of the business, and disagreements between partners can be difficult to resolve.

3) Limited Liability Company (LLC)

A limited liability company, or LLC, is a type of business entity that provides limited liability to its owners. This means that the owners of an LLC are not personally responsible for the debts and liabilities of the business. The advantages of an LLC for a cookie business include flexibility in management, pass-through taxation (avoids double taxation as explained below), and limited personal liability. The disadvantages of an LLC include lack of availability in some states and self-employment taxes.

4) C Corporation

A C Corporation is a business entity that is separate from its owners. It has its own tax ID and can have shareholders. The main advantage of a C Corporation for a cookie business is that it offers limited liability to its owners. This means that the owners are not personally responsible for the debts and liabilities of the business. The disadvantage is that C Corporations are subject to double taxation. This means that the corporation pays taxes on its profits, and the shareholders also pay taxes on their dividends.

5) S Corporation

An S Corporation is a type of corporation that provides its owners with limited liability protection and allows them to pass their business income through to their personal income tax returns, thus avoiding double taxation. There are several limitations on S Corporations including the number of shareholders they can have among others.

Once you register your cookie business, your state will send you your official “Articles of Incorporation.” You will need this among other documentation when establishing your banking account (see below). We recommend that you consult an attorney in determining which legal structure is best suited for your company.

4. Secure Startup Funding for Your Cookie Business (If Needed)

In developing your cookie business plan , you might have determined that you need to raise funding to launch your business.

If so, the main sources of funding for a cookie business to consider are personal savings, family and friends, credit card financing, bank loans, crowdfunding and angel investors. Angel investors are individuals who provide capital to early-stage businesses. Angel investors typically will invest in a cookie business that they believe has high potential for growth.

5. Secure a Location for Your Business

When looking for a location for your cookie business, keep a few things in mind. You’ll need a space big enough to accommodate your baking equipment and workspace and a storage area for your ingredients and finished cookies. You’ll also want to ensure the facility is in a safe, accessible location with good foot traffic.

6. Register Your Cookie Business with the IRS

Next, you need to register your business with the Internal Revenue Service (IRS) which will result in the IRS issuing you an Employer Identification Number (EIN).

Most banks will require you to have an EIN in order to open up an account. In addition, in order to hire employees, you will need an EIN since that is how the IRS tracks your payroll tax payments.

Note that if you are a sole proprietor without employees, you generally do not need to get an EIN. Rather, you would use your social security number (instead of your EIN) as your taxpayer identification number.

7. Open a Business Bank Account

It is important to establish a bank account in your cookie business’ name. This process is fairly simple and involves the following steps:

- Identify and contact the bank you want to use

- Gather and present the required documents (generally include your company’s Articles of Incorporation, driver’s license or passport, and proof of address)

- Complete the bank’s application form and provide all relevant information

- Meet with a banker to discuss your business needs and establish a relationship with them

8. Get a Business Credit Card

You should get a business credit card for your cookie business to help you separate personal and business expenses.

You can either apply for a business credit card through your bank or apply for one through a credit card company.

When you’re applying for a business credit card, you’ll need to provide some information about your business. This includes the name of your business, the address of your business, and the type of business you’re running. You’ll also need to provide some information about yourself, including your name, Social Security number, and date of birth.

Once you’ve been approved for a business credit card, you’ll be able to use it to make purchases for your business. You can also use it to build your credit history which could be very important in securing loans and getting credit lines for your business in the future.

9. Get the Required Business Licenses and Permits

You’ll need a business license and a food permit to start a cookie business. You may also need a zoning permit if your business is located in a restricted area. Be sure to check with your local government to find out what other permits and licenses you’ll need.

10. Get Business Insurance for Your Cookie Business

The type of insurance you need to operate a cookie business depends on the size and type of your business.

Some business insurance policies you should consider for your cookie business include:

- General liability insurance : This covers accidents and injuries that occur on your property. It also covers damages caused by your employees or products.

- Workers’ compensation insurance : If you have employees, this type of policy works with your general liability policy to protect against workplace injuries and accidents. It also covers medical expenses and lost wages.

- Commercial property insurance : This covers damage to your property caused by fire, theft, or vandalism.

- Business interruption insurance : This covers lost income and expenses if your business is forced to close due to a covered event.

- Professional liability insurance : This protects your business against claims of professional negligence.

Find an insurance agent, tell them about your business and its needs, and they will recommend policies that fit those needs.

11. Buy or Lease the Right Cookie Business Equipment

To start a cookie business, you’ll need some essential equipment. This includes an oven, mixers, baking sheets, and cooling racks. You may also need to purchase a pastry bag and tips, as well as a set of measuring cups and spoons. Be sure to have plenty of storage containers for your cookies.

12. Develop Your Cookie Business Marketing Materials

Marketing materials will be required to attract and retain customers to your cookie business.

The key marketing materials you will need are as follows:

- Logo : Spend some time developing a good logo for your cookie business. Your logo will be printed on company stationery, business cards, marketing materials and so forth. The right logo can increase customer trust and awareness of your brand.

- Website : Likewise, a professional cookie business website provides potential customers with information about the products you offer, your company’s history, and contact information. Importantly, remember that the look and feel of your website will affect how customers perceive you.

- Social Media Accounts : establish social media accounts in your company’s name. Accounts on Facebook, Twitter, LinkedIn and/or other social media networks will help customers and others find and interact with your cookie business.

13. Purchase and Setup the Software Needed to Run Your Cookie Business

To run a cookie business, you will need software to manage the accounting and inventory aspects of the company. You may also want a software to create custom labels and packaging for your cookies. Additionally, you may want to invest in marketing and customer management software.

14. Open for Business

You are now ready to open your cookie business. If you followed the steps above, you should be in a great position to build a successful business. Below are answers to frequently asked questions that might further help you.

Additional Resources:

Cookie Mavericks: www.cookiemavericks.com

How to Finish Your Ultimate Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your cookie business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

How to Start a Cookie Business FAQs

Is it hard to start a cookie business.

No, it's not hard to start a cookie business, but it takes some planning and effort to be successful. You'll need to develop a good cookie recipe, find a source for high-quality ingredients, design attractive packaging, and market your cookies to potential customers.

How can I start a cookie business with no experience?

To start selling cookies with no experience, you'll need to do some research on the industry and learn as much as you can about the process. You may want to seek advice from other cookie business owners. You can also find resources online or take some community college courses to hone in on your baking skills and learn how to run a small business.

What type of cookie business is most profitable?

The most profitable type of cookie business is a specialty cookie business. This type of business produces unique, high-quality cookies that are sold at a premium price. Specialty cookie businesses often have a loyal customer base willing to pay more for their cookies. These businesses typically have a higher overhead than mass-produced cookie businesses, but higher prices allow them to make a profit.

How much does it cost to start a cookie business?

It can cost anywhere from $5,000 to $10,000 to start a cookie business. This includes the cost of the necessary equipment, ingredients, and supplies.

What are the ongoing expenses for a cookie business?

The ongoing expenses for a cookie business can include ingredients, packaging, shipping, and labor. In addition, a business owner may need to account for rent or lease payments, equipment costs, and advertising and marketing expenses.

How does a cookie business make money?

A cookie business typically makes money by selling different types of cookies to customers from chocolate chip cookies to gluten-free cookies . The business may also sell other baked goods, such as cakes and pastries to local stores, grocery stores, farmers markets, and cafes . The business may also generate income through the sale of baking supplies, such as cookie cutters and icing. Some cookie businesses also offer catering services.

Is owning a cookie business profitable?

Owning a cookie business can be profitable because there is consistent demand for cookies, and they are relatively inexpensive to produce. Additionally, there are many different ways to market and sell cookies, which means that there is a lot of potential for profit.

Why do cookie businesses fail?

A number of factors can contribute to the failure of a cookie business. One of the most common is a lack of planning and preparation. Other factors may include a lack of effective marketing, not making enough sales to cover overhead expenses, and financial mismanagement.

Where Can I Download a Cookie Business Plan PDF?

You can download our cookie business plan PDF template here. This is a business plan template you can use in PDF format.

Other Helpful Business Plan Articles & Templates

- Business Ideas

- Registered Agents

How to Start a Cookie Business in 14 Steps (In-Depth Guide)

Updated: February 27, 2024

BusinessGuru.co is reader-supported. When you buy through links on my site, we may earn an affiliate commission. Learn more

The cookie industry is always making waves. Nobody can resist the versatility of these delectable treats. With a compound annual growth rate (CAGR) of 6.43% between 2022 and 2030, the market could reach $45.4 billion by 2030.

This comprehensive guide will walk you through all the details of how to start a cookie business. Topics include market research, competitive analysis, registering an EIN, applying for business insurance, obtaining a business license, buying a domain name, and more. Here’s everything you need to know about developing a business plan for your homemade cookie business.

1. Conduct Cookie Market Research

Market research is essential to owning your own business. It helps you develop a strong business plan by revealing details about your target market, local market saturation, trends in products, and more.

Some details you’ll learn through market research include:

- The average American eats 35,000 cookies over their lifetime – that’s around 20 pounds per person per year!

- The most popular varieties remain chocolate chip, oatmeal raisin, and peanut butter. However, gourmet and specialty options are a fast-growing niche.

- Cookie businesses can sell in a variety of settings including bakeries, farmer’s markets, grocery stores, and popup cookie stands.

- Younger generations especially want exciting new flavors and premium ingredients in their cookies. Think sea salt caramel, chocolate espresso, lemon lavender, or even unexpected varieties like rosemary olive oil and matcha green tea.

- Another key opportunity lies in targeting health-conscious consumers. Gluten-free, paleo, vegan, and clean-label cookie sales are surging.

- Formulating recipes that are free of artificial ingredients and high in nutrients can attract modern buyers.

- There is also huge potential in gift-giving. Packaging cookies in artisanal tins, boxes, or baskets makes for popular presents.

- Holidays like Christmas and Valentine’s Day see peak cookie gifting activity. Birthdays and thank-you gifts also drive sales.

- E-commerce presents a low-cost route to customers. Building an appealing online shop can garner orders across the country.

- Lucrative opportunities also exist in wholesaling cookies to coffee shops , hotels, airlines, schools, offices, and grocery store bakeries.

- Large-scale commercial production would be needed to supply steady volumes.

Overall, the diverse tastes, traditions, and preferences around cookies globally create an industry ripe for innovation. Passionate bakers who focus on quality, fill unmet needs, and leverage online channels can craft a recipe for success.

2. Analyze the Competition

Thoroughly analyzing the competition is crucial when breaking into the cookie market. There are likely numerous existing cookie companies, both local and national.

From the cottage food industry to the gourmet bakery grind, your competitors offer a lot of information on where to sell cookies, what to include in your marketing plan, and even how to attract customers.

Some ways to get to know your competitors include:

- Research who the major players are in your geographic area for in-store cookie sales. Visit their shops, sample products, and scrutinize pricing.

- Look at their branding and marketing, and what makes them stand out. This enables the creation of differentiated offerings.

- Investigating online competitors is also key. Search for highly-rated local and regional cookie companies with robust e-commerce operations. Check if they’re a part of any subscription boxes or catering company product offers. Adjust your strategy appropriately.

- Study their selection, web design, photography, copywriting, and ease of ordering. Examine their shipping costs, delivery times, and packaging.

- Analyze their social media and online marketing strategy. Do they leverage Facebook ads, Instagram influencers, and clever hashtags? How do they build their brand and engage customers digitally?

- Sign up for their email lists to get insights on promotions and new product launches. Note special holiday offerings and gifting packages that inspire gift-giving.

- Studying consumer reviews is also invaluable for identifying shortcomings and opportunities. If buyers commonly complain about excessive sugar, lack of healthy options, or shipping mishaps, those become openings to outperform competitors.

- Online cookie sales are estimated to reach $43.5 billion by 2027 as more buying shifts online. Standing out in this expanding digital marketplace requires in-depth competitive analysis and the agility to beat competitors on selection, service, marketing, and delivery.

Dedicate time to knowing the strengths and weaknesses of cookie competitors. This knowledge will pay dividends when translating your offerings into success.

3. Costs to Start a Cookie Business

Starting a cookie business requires careful financial planning and cost analysis. Between initial investments in equipment and ingredients to ongoing expenses like labor and marketing, budgets can climb quickly. Here is a realistic breakdown of what small business owners can expect to spend launching and running a cookie company:

Start-Up Costs

- Commercial Kitchen – Renting or building out a licensed commercial kitchen is one of the biggest start-up costs, ranging from $2,000-$5,000 per month depending on size, location, and features.

- Equipment – Outfitting a commercial baking space requires significant equipment like high-capacity ovens ($5,000-$10,000), mixers ($2,000-$5,000), sheet pans ($500), cooling racks ($300), and utensils ($1,000).

- Ingredients – Stocking up on ingredients like flour, sugar, eggs, butter, chocolate, nuts, and flavorings requires sizable upfront funds. For a moderate-sized operation, plan on allocating around $5,000-$10,000 to your initial ingredient inventories.

- Packaging – Items like custom cookie boxes, bags, labels, and sealing stickers carry costs. Budget around $2,500 initially for attractive packaging supplies.

- Website Development – A professional e-commerce-enabled site with integrated payment processing typically costs $3,000-$5,000. Allow $4,000 for a quality cookie site.

- Business Formation – Formation documents, licenses, permits, insurance, and any legal fees can cost around $2,000 to fully establish your business.

- Working Capital – Having around 6 months of working capital on hand is recommended when starting a business. With the above figured in, have at least $40,000 available to cover operating expenses as sales ramp up.

Total startup costs could run between $75,000 – $100,000.

Ongoing Costs

- Commercial Kitchen Rent – At $3,500 per month, plan on $42,000 annually in rent or mortgage payments for your baking business space.

- Ingredients – Depending on your order volumes, ingredient costs may range from $5,000-$15,000 per month, or $60,000 – $180,000 annually.

- Packaging – With gift boxes, bags, and other packaging used for orders, expect around $1,500 monthly or $18,000 annually.

- Equipment Maintenance – Figure around 5% of equipment costs annually for maintenance and repairs, around $5,000 budgeted.

- Salaries – For a staff of 5 employees including bakers and drivers, plan on $60,000 – $100,000 in annual salary outlay.

- Insurance – General liability and any other business insurance will likely fall between $2,000 – $5,000 annually.

- Marketing – Budget 5-10% of revenues for marketing costs which could equate to $10,000 – $20,000 annually.

- Other Variable Costs – Expect miscellaneous costs like utilities, delivery fees, and incidentals to add around $500 – $1,500 monthly.

Expect your total ongoing costs to reach $150,000 – $250,000 each year. Starting and running a cookie company demands significant capital outlay for space, equipment, ingredients, labor, and more. Carefully project costs during the planning phase. Seek loans or investors if your savings cannot cover your initial financial needs.

4. Form a Legal Business Entity

Selecting the right legal structure is key when starting a cookie company. The four main options each have advantages and drawbacks to weigh.

Sole Proprietorship

The simplest structure is where you alone own the business. No formal registration is required beyond licenses. The setup is fast and inexpensive.

However, you assume unlimited personal liability for the business. If the company is sued or goes into debt, your assets can be seized. For a food business like cookies, this risk is too high.

Partnership

A partnership spreads ownership between 2 or more people. You share control and liability. Formal partnership agreements are recommended to assign duties and percentages of ownership.

Yet your assets remain at risk unless you establish a Limited Partnership. Disagreements between partners can also dissolve the business. Overall too risky for a young cookie company.

Limited Liability Company (LLC)

LLCs limit owner liability and allow tax flexibility. Owners are shielded from company debts and lawsuits. You get the credibility of a legal corporation with less paperwork.

For a small cookie startup, forming an LLC offers the best protections. Liability coverage to safeguard personal assets makes an LLC ideal. Costs are reasonable at $500-$1500 to establish depending on your state.

Corporation

A C corporation is a separate legal entity from its owners. It offers complete limited liability and the ability to raise investment capital by selling shares of stock.

The downsides are extensive corporate taxes and recordkeeping requirements. For a bootstrapped cookie startup, the high costs and complexities of a corporation are needless. An LLC provides all the core benefits.

5. Register Your Business For Taxes

One key legal step for any new business is obtaining an Employer Identification Number (EIN) from the IRS. This unique number functions like a social security number for your business.

An EIN is mandatory if you plan to hire employees, open business bank accounts, or file taxes for your cookie company. The good news is applying takes just minutes online.

Simply navigate to the IRS EIN Assistant and select the option that best describes your cookie business structure. You’ll need to provide basic information like name, address, and ownership details. [1]

Next, specify whether you expect to hire employees within the next 12 months. If so, you must get an EIN even as a sole proprietor. The site then walks you through additional confirmation steps.

Once submitted, you’ll receive your EIN immediately on screen. Print this page for your records. You’ll need your EIN anytime you open a business bank account or fill out legal paperwork.

The entire online application takes less than 15 minutes in most cases. The EIN is free to obtain and you can use it at any time. No need to wait until your cookie business is up and running.

Besides applying for your federal EIN, don’t forget to contact your state revenue or taxation department to obtain any required state IDs for reporting sales tax. This step is crucial if selling cookies in person.

6. Setup Your Accounting

Careful accounting is crucial when starting a cookie business. Proper bookkeeping and financial organization will save major headaches down the road. Here are some best practices:

Accounting Software

Invest in small business accounting software like QuickBooks . This automates tasks like invoicing, reporting, and reconciling bank statements. As your cookie sales grow, tracking finances via spreadsheets becomes unmanageable.

Linking QuickBooks to business bank accounts and credit cards provides real-time visibility of cash flow and expenses. Reports can detect profitability by product line or sales channel. Software like QuickBooks costs around $10-$50 per month but provides invaluable financial clarity.

Hire an Accountant

Hiring an accountant, at least part-time, is also advisable. An accountant handles bookkeeping, monitors income and expenses, manages payroll taxes, and files quarterly and annual tax returns. Expect fees of $800-$2,000 to have an accountant prepare your yearly taxes.

For audit protection and tax savings, have an accountant review your cookie business finances monthly or quarterly. They can spot issues early and ensure proper categorization of expenditures. Their expertise saves both time and tax dollars.

Open a Business Bank Account

Separate all cookie company finances from your accounts. Keep expenses isolated by having dedicated business checking/savings accounts and credit cards solely for the bakery. Never come funds or pay suppliers from personal accounts.

Apply for a Business Credit Card

To obtain a business credit card, contact issuers like CapitalOne or Chase and provide your EIN, company financials, and ownership information. Credit limits will equal a percentage of your business assets and projected revenues.

7. Obtain Licenses and Permits

Before selling your first cookie, it’s crucial to get the necessary licenses and permits. Find details on federal license requirements through the U.S. Small Business Administration . The SBA also offers insight into state and city regulations.

At the federal level, all commercial kitchens require a food facility registration with the FDA. This verifies you meet sanitation, health, and safety standards. Registration takes just a few hours online and costs around $175 per facility.

Additionally, commercial bake sites need certification from the county health department. Inspectors will check refrigeration, sanitation, prep surfaces, and storage. Initial certification costs approximately $500-750 depending on your locality.

Don’t forget local business licenses required in your city, county, or state. These verify legal approval to operate within zoning codes and require annual renewal. Permit fees are typically based on square footage and range from $50 to several hundred dollars.

If selling cookies online across state lines, you may need compliance with cottage food laws that regulate cross-state commerce. Rules vary but food safety training or special packaging is often required.

Selling cookies at markets, fairs, or pop-up events? You’ll need approval and temporary food service permits from local regulators to vend on-site. Fees start at around $100 per event.

For delivery vehicles, commercial auto insurance and licensing are mandatory. Depending on the state, delivery drivers may need additional permits or training to transport food orders.

Don’t overlook the Fire Marshal’s office – they handle approvals regarding safety and occupancy codes. Any bakery ovens or sprinkler systems require fire inspections.

While tedious, completing all the steps to legally register and certify your cookie business avoids huge fines from health departments or regulators. Establishing compliance from the start ensures smooth, disruption-free operations.

Don’t let a simple overlooked permit shut down your dreams! Consult local advisors to identify and complete all needed licenses.

8. Get Business Insurance

Business insurance is highly recommended to protect a cookie company’s assets and viability. Without coverage, a single mishap could destroy everything.

Imagine a fire breaks out and destroys your kitchen. Or a delivery truck accident leads to massive lawsuits. Even slip-and-fall customer injuries in your shop could lead to legal and financial crises without insurance.

The right policies greatly limit risks. General liability insurance covers legal fees, settlements, and judgments from bodily injury, property damage, or selling misrepresented products. Minimum $1 million policies start around $30/month.

Product liability protects if cookies directly cause harm or illness. At about $40/month, it’s cheap peace of mind.

Commercial property coverage replaces stolen, vandalized, or destroyed ovens, freezers, ingredients, and other assets. Expect costs of 2-5% of insured property value.

9. Create an Office Space

Having a dedicated office provides room for core baking operations or administrative work depending on your needs. Here are some potential options:

Home Office

Working from a spare room or basement in your home costs nothing extra. It allows for handling recipe development, phone calls, and computer tasks in a private workspace.

The downsides are the lack of a professional atmosphere for meetings and minimal separation between work and personal life. Still, a basic home office runs under $100 for a desk and chair. It offers the most affordable option to start.

Coworking Space

Shared offices like WeWork provide amenities like WiFi, conference rooms, and kitchen access for around $300 per month. This enables meeting suppliers or hosting pop-ups and events.

Coworking spaces also foster community and connections with other entrepreneurs. However, they lack production facilities for baking in-house. Better for administrative tasks than production.

For maximum brand visibility and walk-in traffic, consider a retail cookie shop. Renting a 700 sq ft store starts at around $3,000 monthly. Displays and sampling entice impulse purchases.

This space works when selling directly to consumers. However, a separate commercial kitchen is still ideal for high-volume baking. The store becomes your decorated retail face.

Commercial Kitchen

Renting a 1000-square-foot industrial kitchen enables scaling up production capacity. Commercial spaces with zoning approval, ventilation, and gas hookups rent for approximately $3,500 monthly.

Access to high-output ovens and equipment allows for baking thousands of cookies per day. The prime option is once online sales are surging.

10. Source Your Equipment

A commercial kitchen requires significant specialized equipment like ovens, mixers, sheet pans, and refrigeration. Here are tips for acquiring essential items:

For brand-new ovens, mixers, food processors, and other appliances, restaurant supply retailers like Webstaurant Store , BakeDeco , and Culinary Depot offer wide selections online. Expect premium prices but manufacturer warranties.

Buying new makes sense for key tools you’ll use daily. However, buying every item new strains startup budgets. Utilize alternative sources too.

Buying Used

Gently used equipment offers major savings. Check restaurant auction sites like Bid4Assets which lists quality pre-owned items from businesses and institutions. Thriftiness pays off.

Also, browse Craigslist and Facebook Marketplace for sellers in your region. Look into certified refurbished appliances that provide value at reduced cost.

Consider renting certain appliances not needed daily rather than purchasing. Event rental companies like ABC Rentals let you borrow items like high-volume mixers for a flat daily fee.

Renting enables accessing pro gear for holidays and busy seasons without buying specialty items outright. Useful for intermittent heavy production.

Leasing commercial ovens and major appliances spread costs over 3-5 years. Expect monthly payments comparable to renting but you own the equipment after the lease ends.

Leasing works well for major investments like deck ovens. Build equity while easing the initial financial burden. Check specific businesses to find the best used equipment, including candy businesses , donut shops , cake shops, cupcake businesses , and more.

11. Establish Your Brand Assets

Creating a strong brand identity is crucial for making your cookie company memorable. Follow these tips to craft branding that leaves a sweet impression:

Get a Business Phone Number

A professional business line like one from RingCentral reinforces legitimacy. Toll-free and local options with custom greetings start around $25/month.

Dedicated phone numbers enable seamless communications with customers and vendors. Port the number across devices for on-the-go convenience.

Design a Logo

A creative logo encapsulates your brand. Consider an illustrative mark with a cookie, oven mitt, or whisk. Or opt for simple text branding.

Logo makers like Looka provide countless cookie-themed options that you can customize in minutes for around $20.

Print Business Cards and Signage

Business cards from Vistaprint make connecting with potential partners and clients effortless. Custom cards start at $10 for 250.

Window/door signage announces your new shop’s arrival. Roadside banners draw in traffic. Vistaprint has low-cost options.

Purchase a Domain

Buy a catchy .com domain from registrars like Namecheap for your website and email. Aim for your business name or a memorable cookie-related address.

Domains average $15 per year and establish your permanent web presence.

Build a Website

Every cookie company needs a delicious online home. DIY with Wix using their templates and drag-and-drop tools from just $13/month with no coding needed.

Alternatively, hire a skilled web developer on Fiverr for a custom site reflecting your brand starting around $500. A website lets customers learn about your story, shop online 24/7, and stay up to date on new flavors.

12. Join Associations and Groups

Joining local networks and industry groups can provide invaluable connections and insights for cookie entrepreneurs. Here are some to consider:

Local Associations

Join your regional chapter of the Retail Bakers of America Association to access mentorship programs, seminars, and idea exchanges with fellow bakers. Fees start at around $250 annually.

Specialty Food Association supports small food makers through education and events. Memberships begin at around $500 per year.

Local Meetups

Attend food industry mixers and meetups in your city to forge local partnerships and sample products. Sites like Meetup make finding relevant events easy.

Introduce yourself and your cookies at farmers’ markets and craft fairs. Exchange insights with fellow small food businesses in your community.

Facebook Groups

Facebook offers nationwide communities ideal for troubleshooting and feedback. The Cookie Business Owners group has 15K+ members sharing tips and advice.

13. How to Market a Cookie Business

Implementing an effective marketing strategy is essential for generating awareness and sales as a new cookie company. While word-of-mouth referrals from delighted customers are invaluable, you must also prioritize promoting your brand across channels to drive growth.

Cookies for Referrals

Offer free cookies to your first customers in exchange for social media tags, reviews, and referrals. Nothing fuels growth like happy patrons sharing their love for your products.

Digital Marketing

- Run Google Ads with tempting images of your cookies and geo-target local customers searching for sweets.

- Create Facebook and Instagram ads highlighting seasonal flavors or gifting. Geo-target nearby customers.

- Post enticing photos and videos on social media using viral trends and dessert hashtags.

- Launch a “Cookie of the Month” club with unique seasonal flavors customers can have automatically shipped. Promote this subscription offer heavily. You could even include your cookies in a subscription box with a similar or identical promotion model.

- Start a bakery TikTok channel with mesmerizing behind-the-scenes baking videos and decorative piping tutorials.

- Film a YouTube series on decorating sugar cookies or developing new recipes.

- Write SEO-optimized blog posts about your special ingredients, founder’s story, or tips for keeping cookies fresh.

Traditional Marketing

- Design bold, mouthwatering mailers and menus to send existing customers and households in your area. Include coupons.

- Partner with local coffee shops and restaurants to get your cookie packages sold and promoted on their shelves.

- Sponsor local events and have a booth on-site allowing sampling and sales.

- Run radio ads emphasizing fast delivery right to local doorsteps.

- Place eye-catching ads in regional magazines and newspapers, especially around holidays.

- Have a vehicle wrap designed for your delivery car to essentially make it a moving billboard.

The cookie market is competitive, but strategic digital and offline promotion will entice new customers to take a bite out of your brand.

14. Focus on the Customer

Providing exceptional customer service is crucial for any cookie company to nurture loyalty and fuel growth through word-of-mouth. Delighting customers leads to powerful referrals and repeat sales.

Some ways to increase customer focus include:

- Respond promptly to inquiries with warmth and care. If a late delivery disappoints a customer, apologize sincerely and offer a replacement basket on the house.

- When customers call with questions about ingredients or nutrition, have thorough answers ready showing your deep care for their needs.

- Make your contact information readily available across your website and packaging. Encourage customers to reach out with feedback on flavors or ideas for custom creations.

- Use surveys or emails to proactively check in on satisfaction. Asking “How can we improve?” demonstrates you value each patron.

- Address complaints immediately and with empathy. If a cookie order arrives with broken pieces, send a complimentary gift card for their next purchase along with your regrets.

- Follow up by name after sales and interactions. Personalized touches like handwritten thank-you notes show customers they matter.

- With each positive experience, you build loyalty and the likelihood of referrals. Someone who raves unprompted to friends about your incredible double chocolate cookies provides your best advertising.

By baking quality into both your cookies and customer interactions, your reputation will rise. Their enthusiasm gives you the ultimate endorsement.

You Might Also Like

February 5, 2024

0 comments

How to Start a Spice Business in 14 Steps (In-Depth Guide)

The global spice market is hot, valued at over $37.26 billion in 2022, and ...

January 26, 2024

How to Start a Smoothie Business in 14 Steps (In-Depth Guide)

The smoothie industry is booming. The global smoothies market is projected to grow at ...

January 24, 2024

How to Start a Brewery in 14 Steps (In-Depth Guide)

Opening a brewery can be an exciting endeavor for beer lovers looking to turn ...

January 15, 2024

How to Start a Hot Sauce Company in 14 Steps (In-Depth Guide)

The hot sauce market is heating up. The global hot sauce market size was ...

Check Out Our Latest Articles

How to start a dog clothing business in 14 steps (in-depth guide), how to start a vintage clothing business in 14 steps (in-depth guide), how to start a bamboo clothing business in 14 steps (in-depth guide), how to start a garage cleaning business in 14 steps (in-depth guide).

IMAGES

VIDEO

COMMENTS

Cookie Business Plan Template. Your business plan should include 10 sections as follows: Executive Summary. Your executive summary provides an introduction to your cookie shop business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

Make a strategic decision in starting your cookie cutter business with this comparison of company-owned outlets and franchising models. Choose the best fit for your growth projections and control preferences.

Study with Quizlet and memorize flashcards containing terms like Small companies have flourished in the United States because they, _____ aid(s), counsel(s), assist(s), and protect(s) the interests of small business concerns., You should not use a cookie-cutter business plan program because and more.

A cookie business plan example can be a great resource to draw upon when creating your own plan, making sure that all the key components are included in your document. The cookie business plan sample below will give you an idea of what one should look like. It is not as comprehensive and successful in raising capital for your cookie business as ...

Cookie Business Plan Template. The following are the key components of a successful cookie business plan:. Executive Summary. The executive summary of a cookie business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

Here's what you should consider including in your cookie business plan: Executive Summary: An overview of your cookie business, including mission statement and key selling points. ... Supplies: Cookie cutters, parchment paper, food coloring, cake decorations, sprinkles, icing bags, rolling pins. 9. Obtain business insurance for cookie, if required.

Importantly, a critical step in starting a cookie business is to complete your business plan. To help you out, you should download Growthink's Ultimate Business Plan Template here. Download our Ultimate Business Plan Template here. 14 Steps To Start a Cookie Business: Choose the Name for Your Cookie Business; Develop Your Cookie Business Plan

Learn key steps to kickstart your cookie cutter business, from market research strategies to developing a unique brand identity that stands out from competitors.

Here's everything you need to know about developing a business plan for your homemade cookie business. 1. Conduct Cookie Market Research. Market research is essential to owning your own business. It helps you develop a strong business plan by revealing details about your target market, local market saturation, trends in products, and more. Source

If you have a cookie-cutter business and you think a cookie-cutter template that was originally designed for an altogether different kind of business might be the right solution for you, then, by all means, have at it. ... The right business plan consultant knows what mistakes to avoid, and can be a valuable sounding board and long-term partner ...