- Preferences

Personal Financial Management - PowerPoint PPT Presentation

Personal Financial Management

An introduction about personal financial management for family and individual. this includes planning process, focus areas and the consumer activities in planning. – powerpoint ppt presentation.

- Robert Smith

- What is Personal Finance

- Personal Financial Planning Process

- Focus Areas

- Activities of Consumer

- Personal finance is the financial management of an individual or family.

- This includes budgeting, investments, and retirement planning.

- This shows the financial planning process

- Some Personal Financial focus areas

- Financial Position Understanding the availability of personal resources by examining the net worth.

- Adequate Protection The ways to protect the household from unseen risks. The risks are divided into liability, property, health and many more.

- Tax Planning Income tax is one of the largest expense in the household. The question arises when and the amount of taxes you pay . The government provides many incentives and credit, which will reduce the tax burden.

- Investment Planning to collect sufficient money for large purchases. It also includes planning for major life events.

- Retirement Planning It is the process of understanding that how much it costs to live after retirement. Then plan according to it.

- Personal finance is the process through which an individual or family manages money and future.

- If there is less finance or bad credit then there is way to manage them.

- http//en.wikipedia.org/wiki/Personal_finance

- http//www.investopedia.com/terms/p/personalfinanc e.asp

- http//www.yourdictionary.com/personal-finance

- https//48factoring.com/blog/

- http//www.slideshare.net/deborahburns/personal-fi nance-101-ppt

- Thank You !!!

PowerShow.com is a leading presentation sharing website. It has millions of presentations already uploaded and available with 1,000s more being uploaded by its users every day. Whatever your area of interest, here you’ll be able to find and view presentations you’ll love and possibly download. And, best of all, it is completely free and easy to use.

You might even have a presentation you’d like to share with others. If so, just upload it to PowerShow.com. We’ll convert it to an HTML5 slideshow that includes all the media types you’ve already added: audio, video, music, pictures, animations and transition effects. Then you can share it with your target audience as well as PowerShow.com’s millions of monthly visitors. And, again, it’s all free.

About the Developers

PowerShow.com is brought to you by CrystalGraphics , the award-winning developer and market-leading publisher of rich-media enhancement products for presentations. Our product offerings include millions of PowerPoint templates, diagrams, animated 3D characters and more.

Free Personal Finance PowerPoint Template

A personal finance template design for powerpoint presentations.

Free personal finance PowerPoint template is an editable presentation template that you can use to prepare presentations on personal finance for PowerPoint and Google Slides.

What is personal finance? Personal finance is the management of money and financial affairs. It includes budgeting, saving, investing, and insurance.

In this personal finance PPT template you can graphs or charts to help illustrate financial trends and data. It could also include text boxes with specific tips or advice related to personal finance. Additionally, it might be helpful to have a section for speaker notes, so that presenters can keep track of what they want to say during the presentation.

You can download this personal finance PowerPoint PPT Template to make presentations on finance education as well as other finance related presentations using a wallet design and blue background with grey. This free personal finance presentation template with wallet illustration and money can be used in personal loads presentations and presentations on virtual business personal finance, free download personal finance PowerPoint templates for money presentations.

PPT Size: 241.3 KB | Downloads: 21,200

Download 2194_personal_finance.zip

Download In Progress…

Download will begin shortly. If you liked our content, please support our site helping us to spread the word. This way we can continue creating much more FREE templates for you.

For serious presenters, we recommend...

Slidemodel.com.

Fast-growing catalog of slide templates. More than 50,000 PowerPoint Templates & Diagrams for Presentations.

Presenter Media

Animated PowerPoint Templates, 3D templates and Cliparts for PowerPoint

Register for FREE and Download

We will send you our curated collections to your email weekly. No spam, promise!

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser.

Newly Launched - AI Presentation Maker

- Personal Financial Management

- Popular Categories

AI PPT Maker

Powerpoint Templates

PPT Bundles

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Powerpoint Templates and Google slides for Personal Financial Management

Save your time and attract your audience with our fully editable ppt templates and slides..

Presenting Personal Financial Management Advice In Powerpoint And Google Slides Cpb slide which is completely adaptable. The graphics in this PowerPoint slide showcase Four stages that will help you succinctly convey the information. In addition, you can alternate the color, font size, font type, and shapes of this PPT layout according to your content. This PPT presentation can be accessed with Google Slides and is available in both standard screen and widescreen aspect ratios. It is also a useful set to elucidate topics like Personal Financial Management Advice. This well-structured design can be downloaded in different formats like PDF, JPG, and PNG. So, without any delay, click on the download button now.

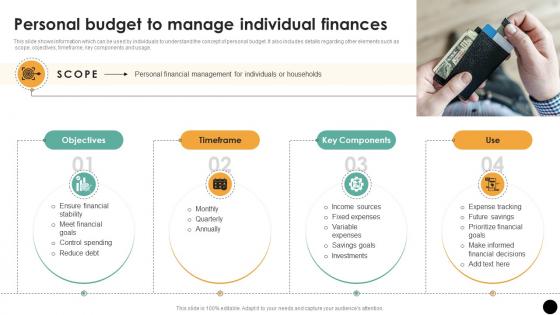

This slide shows information which can be used by individuals to understand the concept of personal budget. It also includes details regarding other elements such as scope, objectives, timeframe, key components and usage. Increase audience engagement and knowledge by dispensing information using Personal Budget To Manage Individual Finances Budgeting Process For Financial Wellness Fin SS. This template helps you present information on four stages. You can also present information on Objectives, Timeframe, Key Components using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

This slide represents key approaches for effective personal credit management that help ensure financial stability and minimize the risk associated with lending and borrowing. It includes credit score, credit cards and loans. Deliver an outstanding presentation on the topic using this Credit Management Strategies To Minimize Financial Risk Introduction To Personal Finance Fin SS Dispense information and present a thorough explanation of Credit Score, Credit Cards, Loans using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

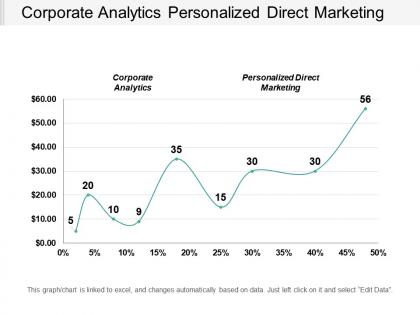

Presenting this set of slides with name - Corporate Analytics Personalized Direct Marketing Financial Performance Work Management Cpb. This is an editable two stages graphic that deals with topics like Corporate Analytics, Personalized Direct Marketing Financial Performance, Work Management to help convey your message better graphically. This product is a premium product available for immediate download, and is 100 percent editable in Powerpoint. Download this now and use it in your presentations to impress your audience.

Presenting our Personal Financial Management Tools In Powerpoint And Google Slides Cpb PowerPoint template design. This PowerPoint slide showcases four stages. It is useful to share insightful information on Personal Financial Management Tools This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

Presenting our Personal Financial Management Tool In Powerpoint And Google Slides Cpb PowerPoint template design. This PowerPoint slide showcases four stages. It is useful to share insightful information on Personal Financial Management Tool. This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

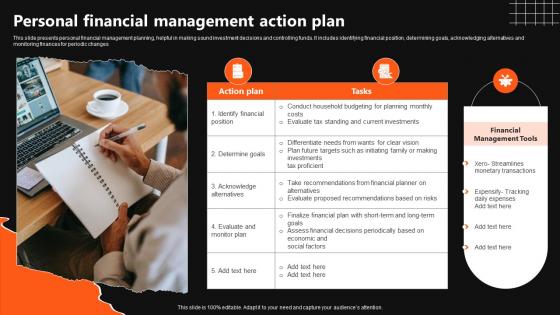

This slide presents personal financial management planning, helpful in making sound investment decisions and controlling funds. It includes identifying financial position, determining goals, acknowledging alternatives and monitoring finances for periodic changes. Introducing our premium set of slides with Personal Financial Management Action Plan. Ellicudate the two stages and present information using this PPT slide. This is a completely adaptable PowerPoint template design that can be used to interpret topics like Action Plan ,Task. So download instantly and tailor it with your information.

Presenting this set of slides with name - Knowledge Skill Development Training Personal Effectiveness Financial Management. This is an editable three stages graphic that deals with topics like Knowledge Skill Development Training, Personal Effectiveness, Financial Management to help convey your message better graphically. This product is a premium product available for immediate download and is 100 percent editable in Powerpoint. Download this now and use it in your presentations to impress your audience.

Presenting this set of slides with name - Communication Strategies Skills Personal Financial Management Techniques Effective Payroll Cpb. This is an editable seven graphic that deals with topics like Communication Strategies Skills, Personal Financial Management Techniques, Effective Payroll to help convey your message better graphically. This product is a premium product available for immediate download, and is 100 percent editable in Powerpoint. Download this now and use it in your presentations to impress your audience.

Presenting this set of slides with name - Financial Service Technology Enterprise Risk Management Marketing Personalization Cpb. This is an editable one stages graphic that deals with topics like Financial Service Technology, Enterprise Risk Management, Marketing Personalization to help convey your message better graphically. This product is a premium product available for immediate download, and is 100 percent editable in Powerpoint. Download this now and use it in your presentations to impress your audience.

Presenting this set of slides with name - Teamwork Skill Anger Management Activities Personal Financial Management Cpb. This is an editable four stages graphic that deals with topics like Teamwork Skill, Anger Management Activities, Personal Financial Management to help convey your message better graphically. This product is a premium product available for immediate download, and is 100 percent editable in Powerpoint. Download this now and use it in your presentations to impress your audience.

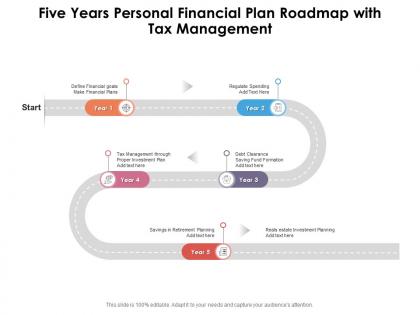

Presenting Five Years Personal Financial Plan Roadmap With Tax Management PowerPoint slide which is 100 percent editable. You can change the color, font size, font type, and shapes of this PPT layout according to your needs. This PPT template is compatible with Google Slides and is available in both 4,3 and 16,9 aspect ratios. This ready to use PowerPoint presentation can be downloaded in various formats like PDF, JPG, and PNG.

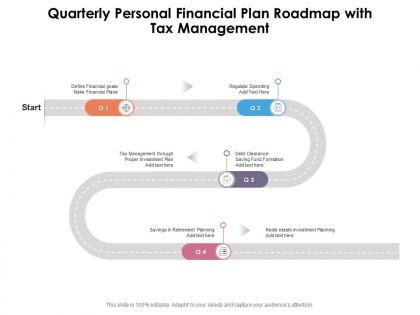

Presenting Quarterly Personal Financial Plan Roadmap With Tax Management PowerPoint Template. This PPT presentation is Google Slides compatible hence it is easily accessible. You can download and save this PowerPoint layout in different formats like PDF, PNG, and JPG. This PPT theme is available in both 4,3 and 16,9 aspect ratios. This PowerPoint template is customizable so you can modify the font size, font type, color, and shapes as per your requirements.

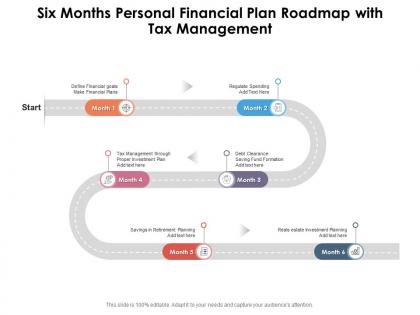

Presenting Six Months Personal Financial Plan Roadmap With Tax Management PowerPoint Template. This PPT presentation is Google Slides compatible hence it is easily accessible. You can download and save this PowerPoint layout in different formats like PDF, PNG, and JPG. This PPT theme is available in both 4,3 and 16,9 aspect ratios. This PowerPoint template is customizable so you can modify the font size, font type, color, and shapes as per your requirements.

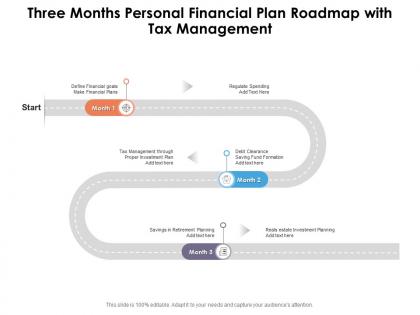

Presenting Three Months Personal Financial Plan Roadmap With Tax Management PowerPoint Template. This PPT presentation is Google Slides compatible hence it is easily accessible. You can download and save this PowerPoint layout in different formats like PDF, PNG, and JPG. This PPT theme is available in both 4,3 and 16,9 aspect ratios. This PowerPoint template is customizable so you can modify the font size, font type, color, and shapes as per your requirements.

Personal Financial Management

Oct 09, 2014

510 likes | 943 Views

Personal Financial Management. Bringing It All Together. Personal Finance Workshops. Budgeting and Debt Reduction Saving and Investing Personal Financial Management Stewardship Charitable Giving. Our mission today. Financial planning Overcoming the fear factor!

Share Presentation

- financial plan

- financial planning

- statistics canada

- comprehensive financial plan

- genesis 41 25 36

Presentation Transcript

Personal Financial Management Bringing It All Together

Personal Finance Workshops • Budgeting and Debt Reduction • Saving and Investing • Personal Financial Management • Stewardship • Charitable Giving

Our mission today • Financial planning • Overcoming the fear factor! • Building a solid foundation • Where to go for more help

People don’t plan to fail…..they fail to plan! • Only 28% of households have a comprehensive financial plan • Only 19% express an interest in having a financial plan • Don’t understand the value • Don’t know what a comprehensive plan is • Believe the cost of having such a plan developed by a financial professional is high

Did you know? • God provides us with the knowledge and tools in the bible for sound money management. • New testament: • 215 verses pertaining to faith • 218 verses pertaining to salvation • 2084 versus dealing with stewardship of and accountability for money and finance

How do we create a financial plan? • Define financial planning • Structure of a sound financial plan • Commit to action • Who can help?

What is financial planning? • Where you are today? • Examine your personal finances • Where you want to go? • Define short and long-term goals • Creating the plan to get you from today into tomorrow • Action steps to reach those goals

Your plan will move with you through the various life stages

Speculation Financial Goals & Priorities Protecting Financial Security Key components of a plan

Key components of a plan Speculation Financial Goals & Priorities Protecting Financial Security

Pharaoh's dream Genesis 41:25-36: “...seven cows, fat and sleek came up out of the Nile; and they grazed in the marsh grass…, seven other cows came up after them, poor and very ugly and gaunt…; and the lean and ugly cows ate up the first seven fat cows. Yet when they had devoured them, it could not be detected that they had devoured them; for they were just as ugly as before….I saw also in my dream seven ears, full and good, came up on a single stalk; and lo, seven ears, withered, thin, and scorched by the east wind, sprouted up after them; and the thin ears swallowed the seven good ears.”

Savings and Investments for Retirement Goals, Education, etc. Long Term Care to preserve dignity and family ties at old age (stream of income) Disability Insurance for income preservation while living (stream of income) Life Insurance for income and estate protection on death (lump-sum) Risk Management

Life insurance Financial protection for: Your family and loved ones • Can supplement lost income • Provide funding for child’s education • Debt relief – mortgage, credit cards • Money for funeral and final expenses and taxes

Critical Illness Facts Over 70,000 heart attacks in Canada each year 73,000 died of Heart Disease and Stroke in 2003 159,900 new cases of cancer diagnosed and 72,700 deaths in 2007 Statistics Canada, Canadian Cancer Society, Heart and Stroke Foundation

The need – advances in medicine We are more likely to survive critical illnesses: • Today 59% of people diagnosed with cancer will survive as compared to 1 in 3 in the 1960’s • 80% of heart attack victims survive when admitted to hospital • 75% of stroke victims will survive the initial event, but 60% will be left with a disability We are survivors! Sources: Statistics Canada; Canadian Cancer Society; Heart and Stroke Foundation of Canada

Critical Illness Insurance Pay the bills and more! • Provides you with options • Allows you to focus on getting well • Eliminates money worries • Return of premium option

Wills and Power of Attorney • A Will helps ensure your personal wishes are followed. If you own a personal asset or have children, you should have a Will. • A property power of attorney will make financial decisions on your behalf. • A healthcare power of attorney will take care of your healthcare needs.

Truth about savings and debt Trend #1: Less Saving • Savings rates: 20.2% in the 1982 to 1.2% in 2005 • Half of all Canadians have less than $2500 in savings Trend #2: More Debt • Canadians spend, on average 127% of their income every year • Money is the #1 cause of marital conflict Source: www.crowncanada.ca / Statistics Canada

The Parable of the Talents Matthew 25:14: • 5 talents – put his money to work and gained 5 more • 2 talents – put his money to work and gained 2 more • 1 talent – went out, dug a hole and hid the money For the 2 who put the money to work… “Well done, good and faithful servant! You have been faithful with a few things. I will put you in charge of many things. For the 1 who didn’t…. ‘Evil and lazy servant!.... Then you should have deposited my money with the bankers, and on my return I would have received my money back with interest!’

Wealth creation • The Power of Time • The Power of Compounding • The Importance of Rate of Return

2% 4% 6% 72 / % Interest 8% 10% Time, Compounding and Return Rule of 72 • Dramatic effect of time, compounding and rate of return. • Your money will approximately DOUBLE at a point in time determined by dividing 72 by the percent interest you earn. Values are for illustrative purposes only and may be subject to applicable taxes.

Putting money to work Who Has More at 65? • Investor “A” invests $1,000/year from age 40 to 50 and stops to let it grow or • Investor “B” invests $1,000/year from age 50 to 65?

Retirement savings Most people begin their career with the hope of a good retirement. However by age 65: • 25% have died • 19% have incomes less than $10,000 • 49% have incomes of $10,000 - $35,000 • 7% have incomes of over $35,000 Source – National Council of Welfare, Canada Customs and Revenue Agency, 2001

If you fail to plan… • Inefficient use of resources • Risk of not meeting financial objectives • Unprepared for the storms of life • Pay higher taxes than necessary • Delay retirement; live on less money • May be difficult fulfilling God’s purpose for your life

Commit to action Concrete steps for action • Set goals – spiritual and practical • Assess current situation • Develop action plans • Put your plan into action • Track your progress • Celebrate your successes

Who can help? “Plans fail for lack of counsel, but with many advisors they succeed” Proverbs 15:22

Want to go deeper? To review or start your plan – consider FaithLife Financial Go Green - www.faithlifefinancial.ca • download financial tools • view seminars • calculators • great financial articles

- More by User

Personal Financial Management Seminar

Personal Financial Management Seminar. Office of Frank M. Pees Standing Chapter 13 Trustee. Debtor Education. Personal Financial Management. Meets post-filing financial education requirement. Must show ID and sign-in and sign-out to receive certificate.

896 views • 77 slides

Personal Financial Management . The hidden job retention skill. Who will benefit from this training?. Intensive service providers who work directly with long-term unemployed job seekers.

387 views • 16 slides

Personal Financial Management for Teens

Personal Financial Management for Teens. Presented by Michael A. Goldberg, BComm, BEd Richmond Hill Public Library, April 2012. Agenda. A) Selecting & Opening a Bank Account B) Percentage & Interest Calculation C) Debt & Credit Cards D) Budgeting - managing your Income Savings

717 views • 42 slides

Personal Financial Management for Teens. Presented by Michael A. Goldberg, BComm, BEd Richview Branch, TPL, February 2013. Agenda. A) Budgeting - managing your Income Savings Expenses and budgets more effectively B) Percentage & Interest Calculation C) Saving & Investing

671 views • 42 slides

530 views • 29 slides

Personal Financial Management. Semester 2 2008 – 2009 Gareth Myles [email protected] Paul Collier [email protected]. Reading. Callaghan: Chapter 5 McRae: Chapter 2. Investing in Financial Assets. There are many financial assets available Some are accessible to private investors

425 views • 27 slides

Personal Financial Management. Semester 2 2008 – 2009 Gareth Myles [email protected] Paul Collier [email protected]. Pension Planning. The lectures so far have mostly focused upon managing wealth during employment Many people now retire in their mid 50s

471 views • 28 slides

Personal Financial Management. Sample Exam 2004 – 2005 Prof. Gareth Myles [email protected]. Question 1.

441 views • 24 slides

Personal Financial Management. Sample Exam 2006 – 2007 Prof. Gareth Myles [email protected]. Question 1. How can a financial plan assist the management of personal finances? Illustrate your answer by constructing a financial plan for someone in mid-career aiming for early retirement.

514 views • 30 slides

Personal Financial Management. Semester 2 2008 – 2009 Gareth Myles [email protected] Paul Collier [email protected]. Reading. Callaghan: Chapter 6 McRae: Chapter 3. Investing in Real Assets. The three major real assets purchased are: Housing Cars Leisure goods

237 views • 16 slides

Personal Financial Management. Semester 2 2008 – 2009 Gareth Myles [email protected] Paul Collier [email protected]. Lecture Notes. These slides are available at: www.people.ex.ac.uk/gdmyles/GDM.html Course Textbook G. Callaghan “Personal Finance” Wiley Secondary Textbook

663 views • 31 slides

Personal Financial Management. Semester 2 2008 – 2009 Gareth Myles [email protected] Paul Collier [email protected]. Reading. Callaghan: Chapter 5 McRae: Chapter 2. Risk and Return. Consider two work colleagues who share a £200,000 lottery win early in 1994

430 views • 32 slides

Personal Financial Management. Semester 2 2008 – 2009 Gareth Myles [email protected] Paul Collier [email protected]. Reading. Callaghan: Chapter 4 McRae: Chapter 8. Interest and Interest Rates. Some basic information on interest rates Bank of England base rate

358 views • 23 slides

Personal Financial Management. W. Tong (082 922 5269 / [email protected]). Debt Management Part 1: The foundation Part 2: Elimination!!!. Debt Management. Part 1 – The foundation. Who is managing who?. Is your debt managing you ? OR Are you managing your debt ?

354 views • 20 slides

An Introduction about personal financial management for family and individual. This includes planning process, focus areas and the consumer activities in planning.

1.2k views • 11 slides

Personal Financial Management Course

After filing bankruptcy but before you are discharged you are required to a take a mandatory 2 hour debtors education course that is approved by the Department of Justice. Our course meets this requirement and we are nationally approved to provide this course online to those individuals in bankruptcy. Once you have completed the 2 hour requirement you will be issued a debtor education certificate by email that you will submit for your bankruptcy discharge. Visit Us : https://0debteducation.com

165 views • 8 slides

Personal Financial Management Tips

Looking for the best financial advisors online? Here at Millennial Money Minute’s financial blogs you can get top personal financial management tips that will help any individual, small businesses and corporations to achieve their own unique financial goals.

592 views • 4 slides

Personal Financial Management East Rockaway NY

LK Daily Money Management serves as Families with senior members, seniors, busy professionals and people who travel and Widows, widowers, divorcees, help people simplify their everyday financial lives. Call us Now: 516-528-0206

70 views • 6 slides

798 views • 76 slides

Personal Financial Management after Your Residency

Personal Financial Management after Your Residency. Chris Lamoureux, PhD Head of Finance Estes/Neill Professor of Finance University of Arizona. First & Foremost: Do No Harm. Finance is a tool—not an end unto itself.

146 views • 12 slides

IMAGES

COMMENTS

Personal Financial Management after Your Residency. Personal Financial Management after Your Residency. Chris Lamoureux, PhD Head of Finance Estes/Neill Professor of Finance University of Arizona. First & Foremost: Do No Harm. Finance is a tool—not an end unto itself. 225 views • 12 slides

Our Personal Finance PowerPoint presentation template is a versatile and user-friendly tool designed to help individuals manage their finances effectively. ... are a financial advisor looking to educate clients on financial literacy or an individual seeking to improve your own financial management skills, this template provides a comprehensive ...

An Introduction about personal financial management for family and individual. This includes planning process, focus areas and the consumer activities in planning. - A free PowerPoint PPT presentation (displayed as an HTML5 slide show) on PowerShow.com - id: 71dfa5-NzhiN

The final segment ensures the presentation is practical for all users by confirming compatibility with popular platforms like PowerPoint, Google Slides, and Keynote. This ensures that the template can be easily accessed and utilized across different devices and settings, making it a versatile tool for individuals, financial advisors, or ...

Free personal finance PowerPoint template is an editable presentation template that you can use to prepare presentations on personal finance for PowerPoint and Google Slides. What is personal finance? Personal finance is the management of money and financial affairs. It includes budgeting, saving, investing, and insurance.

It includes benefits such as improved financial management, centralized information, customization and convenience. Presenting this PowerPoint presentation, titled Key Benefits Of Using Personal Finance Management Comprehensive Smartphone Banking Formats Pdf, with topics curated by our researchers after extensive research.

Presenting our Personal Financial Management Tools In Powerpoint And Google Slides Cpb PowerPoint template design. This PowerPoint slide showcases four stages. It is useful to share insightful information on Personal Financial Management Tools This PPT slide can be easily accessed in standard screen and widescreen aspect ratios.

Personal Financial Decisions What is Personal finance? It is Everything in your life that involves money. Personal Financial Planning - arranging to spend, save, and invest money to live comfortably, have financial security, and achieve goals. ... Presentation on theme: "Personal Financial Planning"— Presentation transcript: 1 Personal ...

2 OBJECTIVES Describe the importance of personal financial management Identify the significance of money management and budgeting Identify the difference between gross income and net income Create a personal budget Recognize money wasters Identify debt and debt-management resources Identify wise use of credit Describe the importance of savings and investments Protect yourself from identity theft

Personal Financial Management Bringing It All Together. Personal Finance Workshops • Budgeting and Debt Reduction • Saving and Investing • Personal Financial Management • Stewardship • Charitable Giving. Our mission today • Financial planning • Overcoming the fear factor! • Building a solid foundation • Where to go for more help. People don't plan to fail…..they fail to plan!