- Email: [email protected]

Peer-Graded Assignment, Financialization of Housing

- Author / Uploaded

- Jackson Alexander

Peer-graded Assignment: Financialization of Housing (Econ 252b) Please write a short (limit 1000 words) essay on the Uni

Views 7,225 Downloads 202 File size 61KB

Report DMCA / Copyright

Recommend Stories

Financialization of Housing

Financialization of Housing Housing and real estate markets worldwide have been transformed by global capital markets an

952 25 36KB Read more

FINANCIALIZATION OF HOUSING Housing and real estate markets have been transformed by global capital markets and financi

479 26 257KB Read more

Review of The Financialization of a Social Housing Provider.docx

The Financialization of a Social Housing Provider MB Aalbers, Loon, Fernandez. 2017 Highlight The Dutch housing market i

214 13 356KB Read more

Fernandez - Aalbers - Financialization and Housing - 2016

Article Financialization and housing: Between globalization and Varieties of Capitalism Competition & Change 2016, Vol

131 9 308KB Read more

The financialization of housing and the mortgage market crisis

COMPETITION & CHANGE, Vol. 12, No. 2, June 2008 148–166 The Financialization of Home and the Mortgage Market Crisis MAN

172 9 88KB Read more

Rapport - The Financialization of Commodity Markets

The Financialization of Commodity Markets: A Short-lived Phenomenon? Editor: Yves Jégourel The Financialization of Com

0 0 4MB Read more

Housing Systems of Poultry

ANIMAL PRODUCTION Housing Systems of Poultry There are four systems of housing generally found to follow among the poult

134 12 248KB Read more

The Architecture of Housing

450 80 12MB Read more

Theories of Housing Studies

THEORIES OF HOUSING STUDIES 1. Marxist Housing Theory The Marxist theory emerged in the period from 1844 to 1848 as a th

0 0 197KB Read more

Citation preview

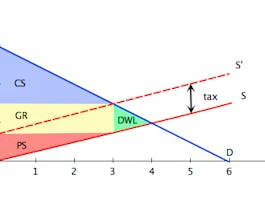

Peer-graded Assignment: Financialization of Housing (Econ 252b) Please write a short (limit 1000 words) essay on the United Nations Human Rights Council's 2017 report on the financialization of housing (relevant links below). You may either agree or disagree with the report. Your grade should not depend on which side you take, just on how well argued your case is. Try to consider principles from this course about the functioning of financial markets, whose purposes they serve, and how they can solve fundamental economic problems, or, perversely, worsen them. Essay on the financialization of housing - http://www.ohchr.org/en/NewsEvents/Pages/DisplayNews.aspx?NewsID=21264&LangID=E Full report, plus additional languages available here - http://www.ohchr.org/EN/Issues/Housing/Pages/AnnualReports.aspx Housing has been financialized: valued as a commodity rather than a human dwelling, it is now a means to secure and accumulate wealth rather than a place to live in dignity, to raise a family and thrive within a community. Housing has become security for financial instruments – traded and sold on global markets. It has lost its currency as a universal human right. Financialization undermines democratic governance and community accountability. International financial institutions and other creditors often require that states be held accountable to global finance rather than to human rights. Governments are more likely to respond to what credit agencies demand than to what human rights require. In financialized housing markets, those making decisions about housing — its use, its cost, where it will be built or whether it will be demolished — often do so from remote board rooms. Real estate billionaires increasingly assume central roles in government and policy making. Financialization of housing exacerbates inequality and social exclusion. It creates more wealth for the wealthy and deprives the poor of housing and communities. It encourages gentrification and displaces the most marginalized, including indigenous peoples, people with disabilities, women and migrants. Financialization detaches housing from its connection to communities and to the human dignity and security that are at the core of all human rights. When housing is bought and sold as a speculative commodity, it becomes dehumanized. The needs of existing residents or the kinds of housing they need is of little concern to global financial investors. When housing is bought up by nameless corporate entities or a multi-billion dollar fund it is difficult to find anyone to hold accountable for human rights. The assumption, bolstered by neo-liberalism, that States should simply allow markets to work according to their own rules, subject only to the requirement that private actors “do no harm” and avoid explicit violations of human rights, is simply not sufficient to meet States’ obligation to fulfil the right to adequate housing “by all appropriate means, including legislative measures.”

Report "Peer-Graded Assignment, Financialization of Housing"

Module 4 Peer Assessment Coursera.pdf - Explore Financial...

- PSG college of technology

- MARKETING 2209

- AmbassadorProtonKoala4

End of preview

Recently submitted questions.

- Online Degrees

- Find your New Career

- Join for Free

Narrative Economics

Taught in English

Some content may not be translated

Financial aid available

29,139 already enrolled

Gain insight into a topic and learn the fundamentals

Instructor: Robert Shiller

Top Instructor

Included with Coursera Plus

(437 reviews)

Recommended experience

Beginner level

Available to everyone

What you'll learn

How and why certain stories go viral.

How viral narratives shape public beliefs and influence our decision making.

Skills you'll gain

- Research Methods

- Financial Markets

- Storytelling

Details to know

Add to your LinkedIn profile

4 assignments

See how employees at top companies are mastering in-demand skills

Earn a career certificate

Add this credential to your LinkedIn profile, resume, or CV

Share it on social media and in your performance review

There are 4 modules in this course

Dear Potential Learner,

Please take some time to read through this note before deciding to enroll. This course, Narrative Economics, is relatively short and proposes a simple concept: we need to incorporate the contagion of narratives into our economic theory. You can think of narratives as stories that shape public beliefs, which in turn influence our decision making. Understanding how people arrived at certain decisions in the past can aid our understanding of the economy today and improve our forecasts of the future. Popular thinking heavily influences our answers to questions such as how much to invest, how much to spend or save, whether to go to college or take a certain job, and many more. Narrative economics is the study of the viral spread of popular narratives that affect economic behavior. I believe incorporating these ideas into our research must be done both to improve our ability to anticipate and prepare for economic events and help us structure economic institutions and policy. Until we better incorporate it into our methods of analysis and forecasting, we remain blind to a very real, very palpable, very important mechanism for economic change. Even in the dawning age of the Internet and artificial intelligence, so long as people remain ultimately in control, human narratives will matter. Maybe they will especially matter as the new technology exploits human weaknesses and creates new venues for narrative contagion. If we do not understand the epidemics of popular narratives, we cannot fully understand changes in the economy and in economic behavior. The course is broken into 4 modules: Part I introduces basic concepts and demonstrates how popular stories change over time to affect economic outcomes, including recessions, depressions and inequality as well as effective inspiration and growth.. These stories can be observed from diverse sources such as politics, the media, or even popular songs. Part II seeks to answer why some stories go viral, while others are quickly forgotten, by defining our narrative theory more firmly. This module enumerates and explores a list of seven propositions to help discipline any analysis of economic narratives. Part III examines nine perennial narratives that have proved their ability to influence important economic decisions. They include narratives regarding artificial intelligence, stock market bubbles, and job insecurity. Part IV looks to the future and highlights the opportunities for consilience in Narrative Economics. We share some thoughts about where narratives are taking us at this point in history and what kind of future research could improve our understanding of them. This course offers only the beginnings of a new idea and a few suggestions for how it could be used by economists and financial professionals. The tone is not prescriptive or authoritative, as perhaps my Coursera course, Financial Markets, is in places. It represents the beginning of the journey (epidemic). This course is my way of floating the “germ” of this idea out into the broader community of not only professionals but of anyone who is interested in discovering how and why things become “important” to us as a society. I hope some of you will become infected by this idea, mutate it, spread it, and advance it. The beginning of the journey is the easy part. The challenge will come in taking these concepts to the next level. We have the tools to incorporate narratives into our research and the moral obligation to act; only the work remains. - Robert J. Shiller

Introduction

Module 1 introduces basic concepts and demonstrates how popular stories change over time to affect economic outcomes, including recessions, depressions, and other important economic phenomena. These stories can come from diverse sources such as politics, the media, or even popular songs.

What's included

9 videos 2 readings 1 assignment

9 videos • Total 47 minutes

- Course Introduction • 2 minutes • Preview module

- The SIR Model • 3 minutes

- Epidemic Curves • 3 minutes

- Where is the Narrative Data? • 4 minutes

- Intro to Ngram • 2 minutes

- Law School • 4 minutes

- Fluctuations in Indicators • 9 minutes

- Prof. Shiller's Narrative • 6 minutes

- Inspirations • 9 minutes

2 readings • Total 20 minutes

- A Personal Note From Robert Shiller • 10 minutes

- Works Referenced in Module 1 • 10 minutes

1 assignment • Total 20 minutes

- Introduction to Narrative Economics • 20 minutes

Seven Propositions of Narrative Economics

Module 2 seeks to answer why some stories go viral while others are quickly forgotten by defining our narrative theory more firmly. This module enumerates and explores a list of 7 propositions to help discipline any analysis of economic narratives.

8 videos 1 reading 1 assignment

8 videos • Total 57 minutes

- Introduction to Propositions • 1 minute • Preview module

- Proposition 1: Epidemics Can Be Fast or Slow, Big or Small • 13 minutes

- Proposition 2: Important Economic Narratives May Comprise a Very Small Percentage of Popu lar Talk • 5 minutes

- Proposition 3: Narrative Constellations Have More Impact Than Any One Narrative • 13 minutes

- Proposition 4: The Economic Impact of Narratives May Change Through Time • 5 minutes

- Proposition 5: Truth Is Not Enough to Stop False Narratives • 9 minutes

- Proposition 6: Contagion of Economic Narratives Builds on Opportunities for Repetition • 3 minutes

- Proposition 7: Narratives Thrive on Attachment: Human Interest, Identity, and Patriotism • 4 minutes

1 reading • Total 10 minutes

- Works Referenced in Module 2 • 10 minutes

- The Seven Propositions • 20 minutes

Perennial Economic Narratives

Module 3 examines nine perennial narratives that have proved their ability to influence important economic decisions. They include narratives regarding artificial intelligence, stock market bubbles, and job insecurity.

10 videos 1 reading 1 assignment

10 videos • Total 83 minutes

- Introduction to Perennial Narratives • 3 minutes • Preview module

- Labor-Saving Machines Replace Many Jobs • 6 minutes

- Automation and Artificial Intelligence Replace Almost All Jobs • 9 minutes

- Frugality versus Conspicuous Consumption • 14 minutes

- Panic versus Confidence • 5 minutes

- The Gold Standard versus Bimetallism • 6 minutes

- Real Estate Booms and Busts • 6 minutes

- Stock Market Bubbles • 15 minutes

- Boycotts, Profiteers, and Evil Business • 10 minutes

- The Wage-Price Spiral and Evil Labor Unions • 4 minutes

- Works Referenced in Module 3 • 10 minutes

1 assignment • Total 30 minutes

- Perennial Narratives • 30 minutes

Consilience

Our last module looks to the future and highlights the opportunities for consilience in Narrative Economics. We share some thoughts about where narratives are taking us at this point in history and what kind of future research could improve our understanding of them.

5 videos 1 reading 1 assignment

5 videos • Total 27 minutes

- Introduction to Consilience • 3 minutes • Preview module

- Education • 3 minutes

- Leadership • 5 minutes

- Doing the Research • 6 minutes

- Your Own Narrative • 8 minutes

- Works Referenced in Module 4 • 10 minutes

1 assignment • Total 15 minutes

- Consilience • 15 minutes

Instructor ratings

We asked all learners to give feedback on our instructors based on the quality of their teaching style.

For more than 300 years, Yale University has inspired the minds that inspire the world. Based in New Haven, Connecticut, Yale brings people and ideas together for positive impact around the globe. A research university that focuses on students and encourages learning as an essential way of life, Yale is a place for connection, creativity, and innovation among cultures and across disciplines.

Recommended if you're interested in Economics

Erasmus University Rotterdam

Introduction to Economic Theories

Duke University

Behavioral Finance

Yale University

The Global Financial Crisis

University of Pennsylvania

Microeconomics: The Power of Markets

Why people choose coursera for their career.

Learner reviews

Showing 3 of 437

437 reviews

Reviewed on Aug 17, 2023

It's a real good course full of history lessons and its narrative expressions that have forged our current economy! The Professor explains everything very clearly and makes it a very fun experience!

Reviewed on Jun 6, 2023

A very insightful and approachable course about the effects of human biases over the economic landscape and how social trends tend to leave a permanent mark on history and exact sciences like finance.

Reviewed on Apr 10, 2023

Very relevant during the reemergence of the AI narrative and concerns about the impact of the technology to employment.

Open new doors with Coursera Plus

Unlimited access to 7,000+ world-class courses, hands-on projects, and job-ready certificate programs - all included in your subscription

Advance your career with an online degree

Earn a degree from world-class universities - 100% online

Join over 3,400 global companies that choose Coursera for Business

Upskill your employees to excel in the digital economy

Frequently asked questions

When will i have access to the lectures and assignments.

Access to lectures and assignments depends on your type of enrollment. If you take a course in audit mode, you will be able to see most course materials for free. To access graded assignments and to earn a Certificate, you will need to purchase the Certificate experience, during or after your audit. If you don't see the audit option:

The course may not offer an audit option. You can try a Free Trial instead, or apply for Financial Aid.

The course may offer 'Full Course, No Certificate' instead. This option lets you see all course materials, submit required assessments, and get a final grade. This also means that you will not be able to purchase a Certificate experience.

What will I get if I purchase the Certificate?

When you purchase a Certificate you get access to all course materials, including graded assignments. Upon completing the course, your electronic Certificate will be added to your Accomplishments page - from there, you can print your Certificate or add it to your LinkedIn profile. If you only want to read and view the course content, you can audit the course for free.

What is the refund policy?

You will be eligible for a full refund until two weeks after your payment date, or (for courses that have just launched) until two weeks after the first session of the course begins, whichever is later. You cannot receive a refund once you’ve earned a Course Certificate, even if you complete the course within the two-week refund period. See our full refund policy Opens in a new tab .

Is financial aid available?

Yes. In select learning programs, you can apply for financial aid or a scholarship if you can’t afford the enrollment fee. If fin aid or scholarship is available for your learning program selection, you’ll find a link to apply on the description page.

More questions

COMMENTS

This video is About : Financial Markets | Coursera | Week 4 Peer-Graded Assignment Answers | 100% Marks.. Course Link to Enroll:https://www.coursera.org/lear...

In This Video Financial Markets Week 4 Coursera Answers with Peer Graded Assignment and Review.Course Link : https://www.coursera.org/learn/financial-market...

This video is About : Financial Markets | Coursera | Week 4 Solutions With Honors Quiz & Assignment | 100% Marks.. Course Link to Enroll:https://www.coursera...

Hi @Aysel12345. If It is a graded peer assignment means you must do and submit your assignment (or) it is a practice assignment means not compulsory to submit the peer assignment. But, you don't submit Graded Peer Assignment means you won't get certificate. So, it's mandatory to complete the graded peer assignment in order to get your course ...

View Coursera Financial Markets Week 4 Peer-Graded Assignment Answers.txt from BBA, OB/HR 101 at Lahore School of Economics, Lahore. ... Log in Join. Coursera Financial Markets Week 4 Peer-Graded Assignment Answers.txt. Doc Preview. Pages 3. Identified Q&As 2. Solutions available. Total views 100+ Lahore School of Economics, Lahore. BBA, OB/HR ...

Peer-graded Assignment: Financialization of Housing (Econ 252b) Please write a short (limit 1000 words) essay on the United Nations Human Rights Council's 2017 report on the financialization of housing (relevant links below). You may either agree or disagree with the report.

Based on the payoffs of two portfolio combinations, a fiduciary call and protective put. Call with Strike X + Present Value of X = Stock Price + Put with Strike X. Study with Quizlet and memorize flashcards containing terms like recessions, the stock market is a leading indicator of a, mortgage lending and more.

View Peer graded assignment week 4. fm.pdf from DDBA 8140 at Walden University. Please write a short (limit 1000 words) essay on the United Nations Human Rights Council's 2017 report on the. ... Financial markets. coursera.pdf. Walden University. DDBA 8140. Final Exam B . Financial markets. coursera.pdf.

In this opening module, you will learn the basics of financial markets, insurance, and CAPM (Capital Asset Pricing Model). This module serves as the foundation of this course. What's included. 23 videos 1 reading 5 quizzes 1 discussion prompt. Show info about module content.

To submit a peer-graded assignment: Navigate to the week or module that the peer-graded assignment is in, then open it. Review the Instructions for the assignment. The course instructor typically provides requirements, submission instructions, and tips. Complete the assignment by responding to each prompt.

Peer-graded Assignment - Financialization of Housing ———————————- Title: I agree with the raising of housing crisis in EU To be convinced by my claim, the first thing a reader needs to know is that I'm living in EU, and current essay is mainly focus on EU countries status about the rising of homelessness, housing problems, and about the wild rent hikes that are leaving ...

Module 4 • 2 hours to complete. In Week 4, you will synthesize your learnings for Finance for Everyone: Markets. You will participate in a peer review of Presentation materials submitted by your classmates, reflect on your key learnings from this course, and look ahead to Finance for Everyone: Value! What's included.

The role of financial markets - Part 1 • 6 minutes; The role of financial markets - Part 2 • 9 minutes; Basic concepts in finance - Part 1 • 2 minutes; Basic concepts in finance - Part 2 • 3 minutes; Basic concepts in finance - Part 3 • 3 minutes; Basic concepts in finance - Part 4 • 5 minutes; Basic concepts in finance - Part 5 ...

An overview of the ideas, methods, and institutions that permit human society to manage risks and foster enterprise. Emphasis on financially-savvy leadershi...

Hello @Elif Yaren Şahan, if you submit a Peer-Graded Assignment early, there may not be enough classmates around to review your work yet. You should receive reviews when you are closer to your deadline, and you can check the deadlines for your assignments by going to your Grades tab in your Course dashboard.

coursera peer graded assignment financial markets | financialization of housing | week 4 #freecertificatecourses #freecourses #certificatecourses #certificateofcompletion #freeudemycourses...

Operational Finance: Building a Robust Business Peer-to-Peer Assessment (Part II of Final Quiz) 1. General instructions: Part II of the final quiz is a peer-to-peer assessment. Once you have submitted your own work, you will be asked to review three of your peers' answers to the same question. The question is worth five points. In order to earn the full six points, you should develop the ...

Specialization - 3 course series. This specialization is intended for students who want to gain a deep understanding of the functioning of financial markets and the role played by financial intermediaries. Students will analyze the role of liquidity in securities markets, and they will understand how security trading is organized and regulated ...

Peer-Graded Assignment - Week 4.Docx - Free download as PDF File (.pdf), Text File (.txt) or read online for free. The document provides instructions for cleaning data in the Titanic.csv dataset using PostgreSQL. It outlines 5 required tasks: 1) handle missing age and cabin data, 2) standardize sex values, 3) create and populate a last name column from name data, 4) create and populate a title ...

There are 4 modules in this course. In this course, you will learn what the main financial markets and their characteristics are as well as how they are linked to the economy. Our very diversified team of experts will start by teaching you how the price of stocks and bonds are computed and why they move while you will become increasingly aware ...

If you unfairly received a 0 or a low grade: Try re-submitting your assignment so other learners can review and grade it. When you re-submit a peer-graded assignment, peer reviews and grades for your first submission will be deleted. In most courses, there's no penalty for resubmitting (except for some Degree and MasterTrack courses).

Financial Accounting: Advanced Topics Week 4 Module 4 Peer Assessment Prev Next PROMPT Please search online business press and find a recent article related to "Cash Flows," "Earnings Quality," or "Detecting Earnings Management." Then please provide the webpage link of the article together with the answers to the following questions.

Click the My Learning tab. Find the course in the list, then open it. In the course sidebar, click Grades. Click the name of the assignment. Click My Submission. If you have grades or feedback, you'll see them at the bottom of each part of your assignment. Note: If you don't see grades and feedback, visit Solve problems with peer-graded ...

To access graded assignments and to earn a Certificate, you will need to purchase the Certificate experience, during or after your audit. If you don't see the audit option: The course may not offer an audit option. You can try a Free Trial instead, or apply for Financial Aid. The course may offer 'Full Course, No Certificate' instead.